16 of the top 30 fastest growing economies in the World are African. This makes Africa a prime destination for investment both foreign and local. This is consistently true even if some ‘nomad capitalists’ say that the prices here are comparatively higher for foreign investors, than in similarly sized economies in different continents around the world. However, this is not too great a deterrent due to the fact that Return on Investment is generally higher in these African economies. These competing realities; of Africa being a prime location for investment, yet seemingly biased toward local investors, provides unique opportunities for African entrepreneurs to define the solutions that will propel our countries forward. The most interesting and successful investors are the ones that have set out to solve preeminent problems with solutions tailored to accommodate the ‘eccentricities’ of African communities. Africa is a prime location for investment, especially of its citizens who have a stake in the future of the continent. I will go on to discuss the achievements and lessons from two African entrepreneurs, to inspire you, towards investment while keeping the greater good in mind. In this way your entrepreneurial endeavours will not only be innovative but also relevant African solutions.

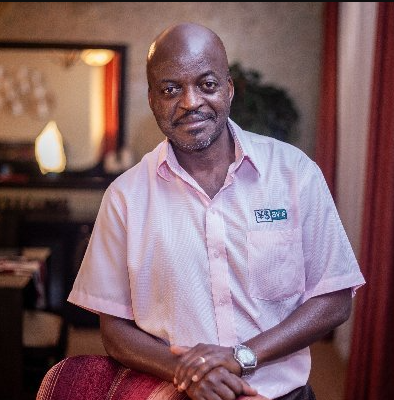

Our first pick is Danstaan Kisuule who is the founder and CEO of Y Save. A multi-purpose cooperative society in Uganda. The reason he starts off our list is because he is that rare breed of entrepreneur whose motivations are rooted in altruism; genuinely more concerned about the collective good than the bottom line. His philosophy is simply explained in a statement he often makes, “If you never save money, you can never have anything”.

Y-Save was started in 2000, initially as a saving & investment scheme by a group of Young Professionals who all attended the same church. At its inception it was called Y-Save Micro Finance Association. It is an organization that champions financial inclusion by seeking to contribute to the effective development of their clients. It is motivated to do so because at their core, Y Save is a financial institution that is God fearing and they desire to be able to impact their society for the better with Godly values.

Dunstan Kisuule gets his inspiration from scripture and this informs his vision and work ethic. One of these verses is Proverbs 6: 6-8 that says, “Go to the Ant you sluggard consider its ways and be wise. It has no commander, no overseer yet it stores its provisions during the summer and gathers its food during the harvest”. He uses the lessons in scripture to help instruct the way the organization operates but also hopes that others will be inspired toward financial responsibility.

Y-Save was started in 2000, initially as a saving & investment scheme by a group of Young Professionals who all attended the same church. At its inception it was called Y-Save Micro Finance Association. It is an organization that champions financial inclusion by seeking to contribute to the effective development of their clients. It is motivated to do so because at their core, Y Save is a financial institution that is God fearing and they desire to be able to impact their society for the better with Godly values.

Dunstan Kisuule gets his inspiration from scripture and this informs his vision and work ethic. One of these verses is Proverbs 6: 6-8 that says, “Go to the Ant you sluggard consider its ways and be wise. It has no commander, no overseer yet it stores its provisions during the summer and gathers its food during the harvest”. He uses the lessons in scripture to help instruct the way the organization operates but also hopes that others will be inspired toward financial responsibility.

He hopes Ugandans develop a culture of saving. Even as the world suffers through the global crisis resulting from the Covid 19 pandemic, he believes that this experience has highlighted, to a new degree, the wisdom in saving and investing in your future. And, will instill the principles of financial responsibility especially among those whose personal finances have been most affected because they had no savings. He cautions against finding excuses that get in the way of strategic personal finance management. And, he says that even having low income is no reason to defer acquiring the discipline of saving, because even the smallest savings appreciate over time and can be invested for profit.

He advises that the most effective way to see savings grow is by becoming involved in savings groups. They are: cheaper and more flexible to accommodate smaller accounts than traditional financial institutions. They also provide necessary networks where one can pool funds with similarly aligned individuals to invest more effectively. This is a prominent feature in the Y Save business model. It engages its members in Investment Clubs that have varied interests in sectors of: Agriculture, Real Estate, Securities, Tourism, and Transport. Other products offered at Y Save include Target accounts, Children’s accounts, Pensions Accounts, Personal Loans, School Fees Accounts and Medical Accounts.

Since its inception, 20 years ago, Y-Save has gone on to thrive and become one of the leading Cooperative organisations in Uganda. With integrity as its foundation, Y-Save believes in establishing godly financial principles because these provide the most enduring, most dynamic and relevant vehicle for financial management, freedom and growth.

The second pick is Nigeria’s Tomie Balogun. A self-titled Millennial Investor, and Founder of Vestract, West Africa’s biggest financial educator; an innovation company focused on delivering financial education to Millennials through multiple means. While her accomplishments are impressive, the reason she makes our list today is because of the way she has been intentional about educating her peers about the realities of Investing.

So much so that this is her most identifiable contribution today, not the initial Investments that got her started. She is a young woman, disavowing the myth that investment, especially in the capital market, is for a select few. She is an avid student of the market and seeks to communicate her hard- earned lessons with her peers in the most accessible way.

Perhaps her clear vision is a result of her own experience. In her own words, “My Investment journey started when I realized I did not own any assets after working really hard for 4 years in a management consulting firm. I got accepted to do my MBA program in 2011 and my ‘no-tangible-wealth’ status hit home.

So much so that this is her most identifiable contribution today, not the initial Investments that got her started. She is a young woman, disavowing the myth that investment, especially in the capital market, is for a select few. She is an avid student of the market and seeks to communicate her hard- earned lessons with her peers in the most accessible way.

Perhaps her clear vision is a result of her own experience. In her own words, “My Investment journey started when I realized I did not own any assets after working really hard for 4 years in a management consulting firm. I got accepted to do my MBA program in 2011 and my ‘no-tangible-wealth’ status hit home.

Right after my MBA program in 2013, I co-founded an Investment Club with four friends and this has taken me on an investment journey filled with gain and loss lessons”. Tomie is motivated to focus on innovative ways to deepen financial literacy across a target demographic which ensures impact and increases the odds of lifting a family above the poverty line. She has a blog, website, YouTube channel (with over 40 videos and over 4,000 subscribers) and a digital platform, The Green Investment Club which provides courses that teach millennials in Africa how to put money to work and collaborate; with investment clubs. She is a big advocate for Investment Clubs and has even authored a book: Investment Clubs: How to Create Wealth beyond your Pay cheque by investing with others.

These two are examples of Africans who have not crossed their arms waiting for help to come from elsewhere but have found ways to empower themselves and more so, the communities around them.

Share this post.

Share on facebook

Facebook

Share on twitter

Twitter

Share on linkedin

LinkedIn

Related posts

Meet the Steve Jobs of the Investment Club Industry.

16 of the top 30 fastest growing economies in the World are African. This makes Africa a prime destination for investment both foreign and local. This is consistently true even if some ‘nomad capitalists’ say that the prices here are comparatively higher for foreign investors, than in similarly sized economies in different continents around the […]

Investment Clubs; Expectation Vs Reality

When was the moment you discovered the wisdom in investing and decided that Investment Clubs were worth paying attention to as your gateway to financial freedom? Were you prompted by the realization that you have been working and earning an income for several years, but have no tangible assets to show for it, or was […]

One Step Closer: Start-Up Uganda Digital Innovation Challenge 2020

In October this year, Kanzu Code responded to Start Up Uganda’s call for applicants to take part in its Digital Innovation Challenge of 2020. This would be the inaugural effort by Start Up Uganda in its commitment to source and build the capacity of promising innovations in various sectors of the eco system. Start Up […]

Meet the Steve Jobs of the Investment Club Industry.

16 of the top 30 fastest growing economies in the World are African. This makes Africa a prime destination for investment both foreign and local. This is consistently true even if some ‘nomad capitalists’ say that the prices here are comparatively higher for foreign investors, than in similarly sized economies in different continents around the […]

Investment Clubs; Expectation Vs Reality

When was the moment you discovered the wisdom in investing and decided that Investment Clubs were worth paying attention to as your gateway to financial freedom? Were you prompted by the realization that you have been working and earning an income for several years, but have no tangible assets to show for it, or was […]

Victory is ours! Women In FinTech Summit 2020

The team from Kanzu Code took part in the Women In Fintech (WIFT) Hackathon and Summit 2020, the first of its kind in Africa. And, they walked away with the topmost prize, for their innovative idea, Kanzu Money: an online bank working to make financing more accessible, especially for local women. It is a mobile […]

Parting Thoughts: Intern Class 2020

The latest crop of interns at Kanzu Code sat down for a debrief, to share from their work experiences this past year. And, based on their one-word descriptions, it is fitting to conclude that it has turned out to be a worthwhile endeavour for each of them. Ahmed, Daniel, Maria and Goretti spoke of the […]